Thoughts On Holding Title

Relationship Status: It’s Complicated!

Does anyone even post that anymore???

I recently handled the Property Purchase for a young couple who found their Dream Home with plans of starting a family – then they Recorded Title in a way that I’d actually never seen before:

“JOHN DOE, A MARRIED MAN, AS HIS SOLE AND SEPARATE PROPERTY, AS TO AN UNDIVIDED 50% INTEREST AND JANE ANYNAME, A SINGLE WOMAN, AS TO AN UNDIVIDED 50% INTEREST, AS TENANTS IN COMMON” (Names changed to protect the innocent J)

Sounds creative, huh? (Call me and I’ll walk you through this one!) This Title Vesting was so clearly designed with a well-thought-out legal purpose that it got me thinking about just how little consideration most of us give to something that can have profound effects on what happens to our (usually) largest asset – Our Home – when it comes to taxes or, perhaps more importantly, in the event of the death or incapacity of a Property Owner – or even an unforeseen break-up of a ‘Happy Couple’.

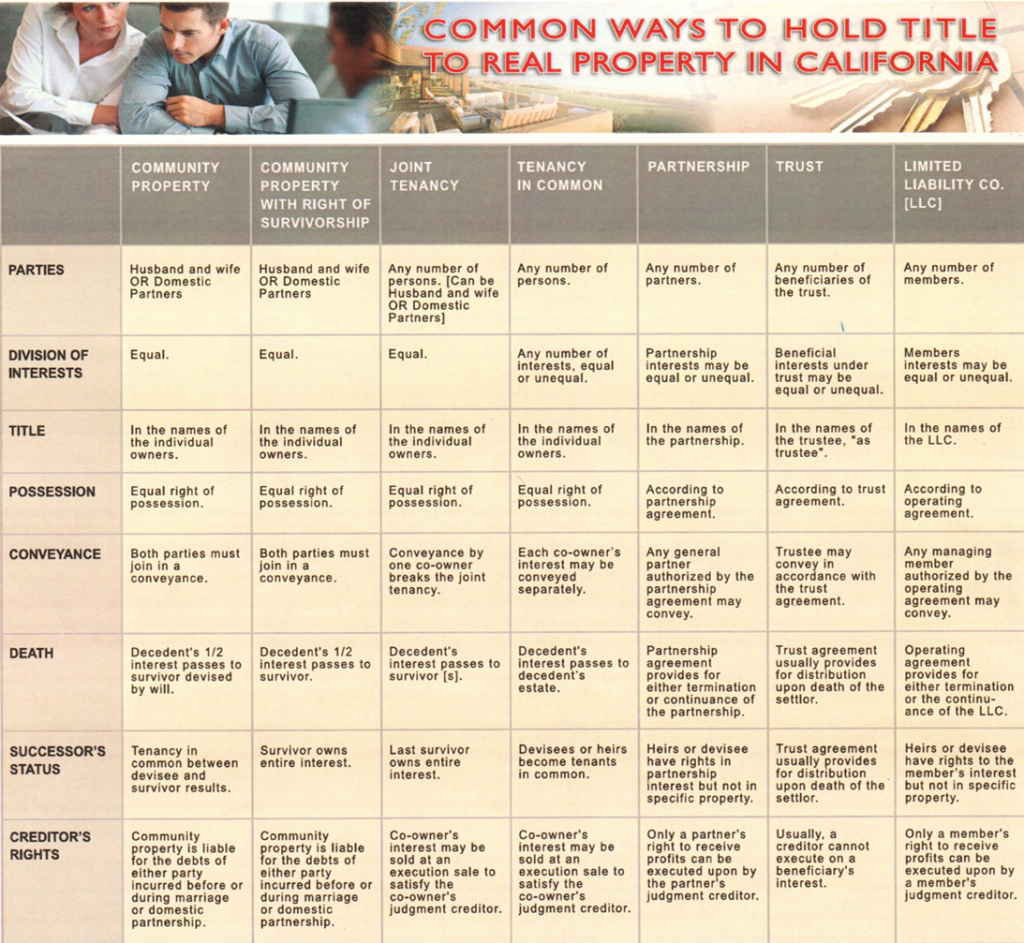

Fortunately most people come to their Home Purchase without too many personal relationship complications when it comes to Recording Title – or at least nothing that can’t be figured out with a simple conversation with me and / or their Escrow Officer and / or Title Officer; Page 2 of this Blog shows the more common ways in which Title can be Vested – But then what???

Have you ever wondered why a growing number of Homeowners establish a “Living Trust” to hold their Real Estate? If you didn’t even know that, you’re not alone!

When properly prepared, a Revocable Living Trust can pay huge dividends, not least of which is to save the family the time and cost of Probate when a Homeowner dies. It can also save on Estate Taxes and protect inheritances for children and grandchildren while allowing the Trustees, typically the Owners of the Trust, to retain complete control of their assets during their lifetime.

Californians have an especially good reason to get a Living Trust as the state does not use the Uniform Probate Code. In other states, this code simplifies the process for Estates going through the Probate Court. Since it isn’t in effect in California, Probate Court can be VERY expensive and can take a VERY long time to resolve – PLUS – being the subject of Probate exposes your Estate to individuals contesting your wishes, including fraudulent claims as the case hits Public Records!

In short: Allowing your assets to be subject to Probate Court is inviting financial disaster!

Establishing a Living Trust is a fairly routine process typically accomplished with advice from an Attorney and / or Financial Planner – Since the Trustee (i.e. Homeowner) retains control of his / her assets, there is little or no difference when it comes to future Listing the Home, completing a Sale, or transferring Title to a new Owner.

Finally, establishing a Living Trust means you won’t have to have a Court Conservatorship placed on your assets in the event you become incapacitated. With a Living Trust, you’ll already have established a Trustee to administer your assets.

Final Thought – Living Trusts vs. Wills

If you decide to get a Living Trust, keep in mind that you could still likely need a Will to distribute assets that are not placed in the Trust. I’m not an Attorney, or a Financial Planner, but I’m always happy to refer you along to highly skilled, experienced Professionals in those fields who would be very happy to help! It’s NOT complicated!

Join The Discussion